ventura property tax due date

On your Annual Property Tax Bill or Supplemental Property Tax Bill. Ventura is the county seat of Ventura County where most local government offices are located.

General Instructions For The Completion Pdf Form 1771

If you purchase in September your due date will be October 30th with a delinquency on November 1.

. Ventura County 2020-21 Secured Property Taxes are due November 1 2020. Business Property Statements are mailed on or about February 1st. For more information call 805 654-2181.

First day to file the Business Property Statement if required or requested with your county assessor last day to file without penalty is May 9. If you purchase unsecured property in august the due date becomes september 30 delinquency occurs on november 1st. Secured Taxes - Ventura County.

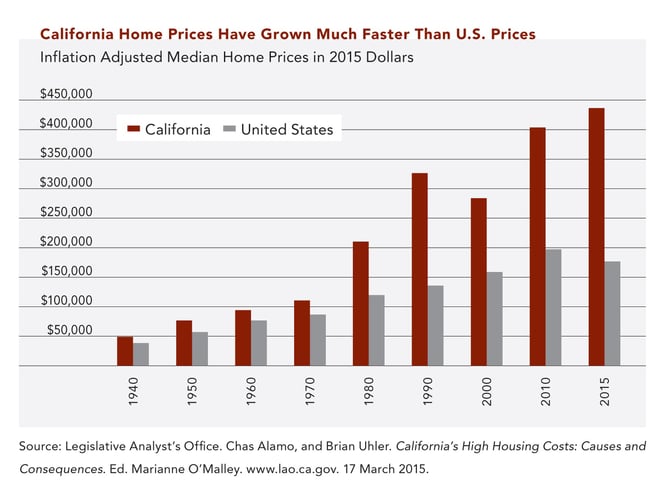

The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. For example an s corporations 2021 tax return due date is. Appealing your property tax appraisal.

December purchases are always billed for taxes due January 31st of the next year. With the help of this rundown youll acquire a helpful sense of real property taxes in Ventura and what you should be aware of when your payment is due. Supplemental bills will have unique due dates as shown on the bill.

If you are contemplating moving there or just planning to invest in the citys property youll discover whether the citys property tax rules are favorable for you or youd rather look for an alternative place. If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due. Ad Pay Your Taxes Bill Online with doxo.

October Purchases Must Be Paid By November 30 While November Purchases Have A Due Date Of December 31. Property Tax Function Important Dates January 2022. Locating tax amounts and payment status for current secured property taxes can be accessed throughout the year on the Tax Collectors website.

Annual secured property tax bill that is issued in the fall. Lien date for all taxable property. Ventura County collects on average 059 of a propertys assessed fair market value as property tax.

2nd Installment is due February 1st delinquent after April 10th. The Second Installment of Ventura County 2020-21 Secured Property Taxes was due February 1 2021. Ventura County 2020-21 Secured Property Taxes are due November 1 2020.

TAX COLLECTOR FAQS - Ventura County. Taxes become a lien on all taxable property at 1201 am. You will need your Assessors Parcel.

Or email questions to. First day to file affidavit and claim for exemption with assessor but on or before 500 pm. For more information go to.

Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after December 10 2020 will be assessed a late payment penalty fee of 10. 800 S Victoria AveThe Ventura County Assessors Office is located in Ventura California. 1st Installment is due November 1st delinquent after December 10th.

Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after December 10 2020 will be assessed a late payment penalty fee of 10. Checking the Ventura County property tax due date. Secured Property Taxes in Ventura County are paid in two installments.

First day to file claim for homeowners or disabled veterans exemption. Taxes paid after April 12 2021 will be assessed a late payment penalty fee of 10 plus a 30 cost. Your property tax bill.

Pursuant to the Executive Stay at Home Order by. The date of delinquency is always one day after the due date. Paying your property tax.

When December 10th or April 10th falls on a Saturday Sunday or legal holiday the delinquency date is the next business day. Payments are due no later than dec. Ventura County 2020-21 Secured Property Taxes are due.

Property tax assessments in ventura county are the responsibility of the ventura county tax assessor whose office is located in ventura california. Thus if an organization were to qualify for the Welfare Exemption in December of 2012 for years 2006 through 2012 had paid taxes on its real property timely for all those years and filed claims for refund of taxes paid it could expect a refund of taxes paid for the first installment due November 1 2012 for both installments due in 2009 2010 and 2011 and possibly for the first. Small business owners with personal property with a value of 10000 or less may be exempt from personal property tax assessment in Ventura County but are still required to file a statement if requested by the Assessor.

1st installment due august 20 covers property taxes for july 1. Revenue Taxation Codes. See the estimate review home details and search for homes nearby.

Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. If you purchase in September your due date will be October 30th with a delinquency on November 1. DUE DATES - Ventura County.

Last day to timely file claim for homeowners or disabled veterans exemption. October purchases must be paid by November 30 while November purchases have a due date of December 31. Pay Your Taxes - Ventura County.

Treasurer-Tax Collector - Ventura County. During this challenging time your patience is. If December 10 or April 10 is a Saturday Sunday or legal holiday the delinquency date is the following business day.

The Impact Of Prop 15 On Commercial Real Estate Lee Associates

The Theory Of International Tax Competition And Coordination Sciencedirect

General Instructions For The Completion Pdf Form 1771

Real Estate Refresher Helpful Tax Provisions In California And Beyond

Law Offices Of Eric Ridley 567 W Channel Islands Blvd Ste 210 Port Hueneme Ca 93041 805 244 5291 Www Ridl Estate Planning Estate Planning Attorney Tax Debt

Understanding California S Property Taxes

Landlord Tenant Attorney Landlord Tenant Being A Landlord Rental

7 Tips For Dealing With A Delinquent Tax Return David Schechtmann Tax Time Tax Day Online Taxes

Property Tax Costs Official Website Surprise Arizona

Ventura County Ca Property Tax Search And Records Propertyshark

Ventura County Assessor Supplemental Assessments

U S States With Highest Gas Tax 2022 Statista

16 Quotation Templates Free Quotes For Word Excel And Pdf Patan Academy Of Health Sciences Quotations Quotation For R Quotations Quotation Format Free Quotes

First Half 2021 Real Estate Tax Bills In The Mail Due February 25

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

Understanding California S Property Taxes

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021